What the Rent?! – State of the Housing Market

There is no question that the cost of living has certainly gone up. We feel it everywhere we look it seems. A website that I enjoying referencing for breaking down complex or otherwise boring economic data is VisualCapitalist.com. This website provides infographics to help make data easier to understand. This graphic regarding inflation is particularly telling of our current economic environment.

When the federal reserve started to raise interest rates and the percentage over list price started to come down I saw the writing on the wall and decided it was time to sell my SFH and make the move to Multi-Family. It’s been a tough road, but 6 months later we finally have a great property under contract.

My focus is now set on the rental market as I will detail for you in this article. Lets dig in!

The Current State of the Market

The past few years which feel like it’s only been a few months have been a true shock to everyone in the market. The most shocking part of the economy is the housing market and more specifically the Rental Market. In my area one of the most active market has been Point Pleasant and Point Pleasant Beach, NJ. Over the past 6 months I have watched consistently as 1000 square foot houses go on the market at $399,999 and close at $425,000 to $450,000.

Point Pleasant is hot because it has all of the right factors that buyers are looking for:

- A Downtown with excellent restaurants and shops

- Its located within 10 minutes at the most from the beach

- About 1 hour to NYC by car and 2 hours by Train

- It’s slowly becoming a higher net worth community

- Great Schools

- Safe Community

- Easy Access to Major Highways

- Rich History and Culture

- Jenkinsons Boardwalk

- Friendly Neighbors / Community

- Single Family Home Price Point Under $500,000

This is quite the list and with an ever-increasing interest rate environment the demand for value and affordability couldnt be more in focus.

How the Market has changed?

The federal reserve started to raise interest rates late spring 2022 into Fall 2022. Back in the fall the interest rate had risen from 3.5% in January 2022 to about 5% in Fall of 2022 and by the End of 2022 the interest rate for the 30 year fixed topped out at 7.5%! Thats an increase of 4% in 12 months!

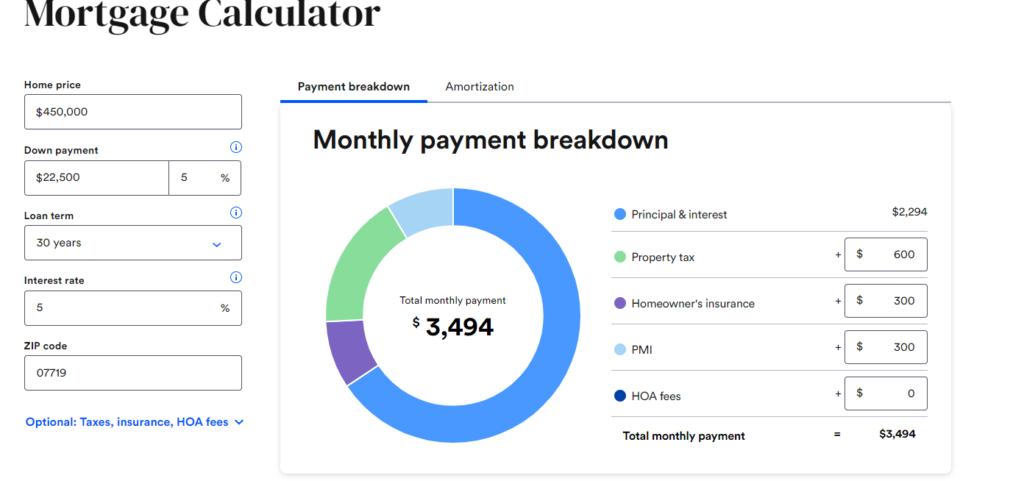

Consider the following scenario for Fall of 2022 for the average closed price for Point Pleasant with an FHA Mortgage. You can try out the calculator at this link:

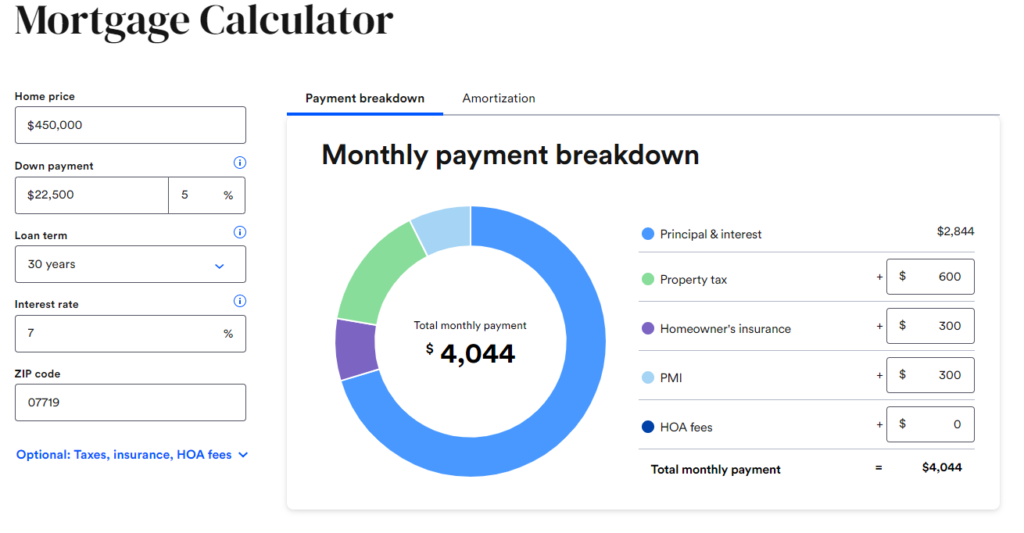

Fast Forward to Spring of 2023. The 30 year fixed FHA rate is hovering around 6.5 to 7.2%. That same home in this scenario would look like this:

A $500 per month increase in 6 months!

Is rent overpriced?

Too often I see people list their property for rent on social media sites and the comments are flooded with statements of outrage and discontent. It really is hard to believe that rental rates have increased to what seems like such a high rate, but as I showed above it is in correlation with rising interest rates. Markets there once $1500 to $2000 markets for a 2 bed are now $2500 to $3500 per month markets.

Do I think this trend of ever increasing rent come to an end? I do not. I think the demand for house is SO strong that rental rates will continue to tick up or at the very least hold and stabilize at these higher rates. Similar to the way that the house market has responded to these interest rates I don’t think rent will come down. We have truly come to point where its cheaper to rent than it is to buy. As long as the cost of the average home in Point Pleasant is $4,000 PLUS and rents are hovering around $2000 to $3000 its Cheaper to RENT than it is to BUY. As long as people don’t have the cash, due to inflation, to close on a single family home and as long Point Pleasant is a vacation rental community on top of full time living community demand will remain strong.